𝐇𝐞𝐥𝐥𝐨 𝐄𝐯𝐞𝐫𝐲𝐨𝐧𝐞 ✨

🛑𝗜𝗻𝘁𝗿𝗼𝗱𝘂𝗰𝗶𝗻𝗴 𝘁𝗵𝗲 𝘀𝗵𝗼𝗿𝘁 𝘀𝘂𝗺𝗺𝗮𝗿𝘆 𝗼𝗳 𝗘-𝘄𝗮𝘆 𝗯𝗶𝗹𝗹 𝗶𝗻 𝗚𝗦𝗧 .

1️⃣𝐖𝐡𝐚𝐭 𝐢𝐬 𝐄-𝐰𝐚𝐲 𝐛𝐢𝐥𝐥?

E-way Bill is an Electronic Way bill for movement of goods to be generated on the eWay Bill Portal. A GST registered person cannot transport goods in a vehicle whose value exceeds Rs. 50,000.

2️⃣𝐌𝐨𝐯𝐞𝐦𝐞𝐧𝐭 𝐨𝐟 𝐆𝐨𝐨𝐝𝐬

E-way bill will be generated when there is a movement of goods in a vehicle/ conveyance of value more than Rs. 50,000 (either each Invoice or in aggregate of all invoices in a vehicle/conveyance) –

🔸In relation to a ‘supply’

🔸For reasons other than a ‘supply’ ( say a return)

🔸Due to inward ‘supply’ from an unregistered person3️⃣𝐖𝐡𝐨 𝐠𝐞𝐧𝐞𝐫𝐚𝐭𝐞 𝐄-𝐰𝐚𝐲 𝐁𝐢𝐥𝐥?

◾Registered Person – Eway bill must be generated when there is a movement of goods of more than Rs 50,000 in value to or from a registered person.

◾Unregistered Persons – Unregistered persons are also required to generate e-Way Bill. However, where a supply is made by an unregistered person to a registered person, the receiver will have to ensure all the compliances are met as if they were the supplier.

◾Transporter – Transporters carrying goods by road, air, rail, etc. also need to generate e-Way Bill if the supplier has not generated an e-Way Bill.

4️⃣𝐌𝐨𝐝𝐞 𝐨𝐟 𝐠𝐞𝐧𝐞𝐫𝐚𝐭𝐢𝐨𝐧.

☑️E-way bill generate through website(online) in which there is SMS based as well as Excel based and Android applications.

E-way Bill generated with wrong information will be cancelled within 24 hours and New E-way bill is generated.

(The Recipient can reject E-way bill within 72 hours of generation of E-way bill)5️⃣𝐏𝐚𝐫𝐭𝐬 𝐨𝐟 𝐄-𝐰𝐚𝐲 𝐁𝐢𝐥𝐥

The E-Way Bill, or GST EWB-01, is divided into two parts: Part A and Part B. Part A contains the products’ information, while Part B contains the vehicle’s identification number.

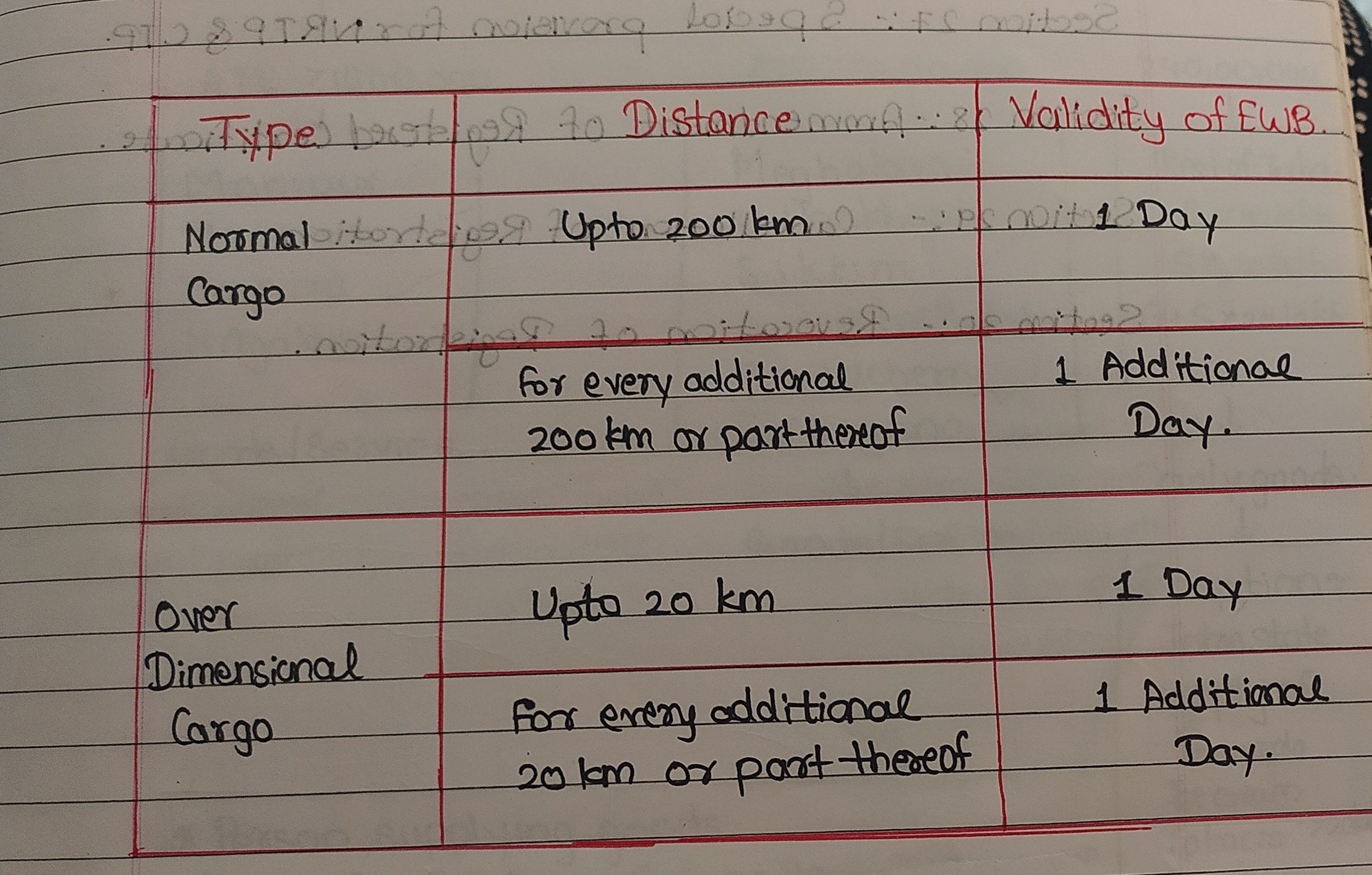

6️⃣𝐕𝐚𝐥𝐢𝐝𝐢𝐭𝐲 𝐨𝐟 𝐄-𝐰𝐚𝐲 𝐁𝐢𝐥𝐥

In below image the provision is summarised.

Friends

Navin Rathod

@navinrathod

Saurabh Jadhav

@saurabhjadhav

Karan Gokani

@karangokani

Aditya Gupta

@adityagupta2175

Aayush Jain

@aayushjain